Sorting bills on your own for the first time can be overwhelming. Luckily, all you need to do is make sure your main bills are paid in full and on time.

- Ways to pay your bills

- What's a lead tenant?

- What does liable party mean?

- What happens if you don't pay bills?

- What's a credit rating?

This guide covers how to pay your student utility bills. We also have a guide toall the bills you need to pay in your student house.

If it all seems too much, you could alwaysget someone to sort your student bills for you...

Ways to pay for your bills

Direct debit

- This is the easiest way to pay your service provider for your bills, and the one we'd always recommend.

- It automatically takes payments out of your account, giving you the best chance of managing your maintenance loan sensibly and paying bills on time.

- All providers accept Direct Debit payments, which makes it quick and easy, so you can stop thinking about water bills as quickly as possible.

- A Direct Debit gives your bank permission to send specific amounts directly from your bank account to a company on a regular basis. You can pay your rent

- Direct Debit is most often used for subscriptions and bills.

- You need to be told in advance how much will be taken and when, so only the agreed amount will come out of your account.

- All Direct Debits come with the Direct Debit Guarantee. This covers lots of stuff, but the big one is that if the wrong payment is taken, or is taken on the wrong date, you get a full refund.

- You can also cancel a Direct Debit at any time.

Anything that makes university life easier get's a big tick in our book. Getting out of student accommodation and into managing everything on your own is hard enough. Easy automated payments is what we'd always recommend.

Card payment

Card payments work in a similar way to a direct debit. Add card details when you sign up, and the agreed amount gets taken out of your account each month. This is just as easy as Direct Debits, but also comes with some pitfalls.

- If you have to cancel your card because it's lost or stolen, your payments will fail and you could end up in arrears 😬

- You'll run into the same problem when your card expires, meaning you need to update your payment details with all of your providers. Ugh.

Split the bills with your bank

Depending which bank you're with, you might be able to split your bills with an in-app feature. This means no more chasing housemates every month, or stressing about whether you've paid your mates back.

- You'll still need to set up with every supplier, and somebody will need to be the lead tenant, but you won't need to remember to chase or pay your housemates every month.

- You still need to set up every service individually

- Your payments might still come out on different dates

Split the bills with a student bills package

This option is a bit different, but makes everything sooooooo much easier.

A student bills package is a custom option for your student house. Put all of the services you want into one package, with one monthly payment split equally between housemates.

Imagine not having to worry about everything in this blog and our other massive bills guide??

How a bills package works:

Step one: Sign up to get a quote for all the services you and your housemates need.- Choose from Energy bills, water bills, broadband deal, TV licence and TV packages.

- Fused's student bills package comes with Unlimited Renewable Energy

Step three: You'll all pay your share of the household bills every month.

If you want to see what the best-rated student bills specialists on Trustpilot could do for you and your housemates, get a quick quote.

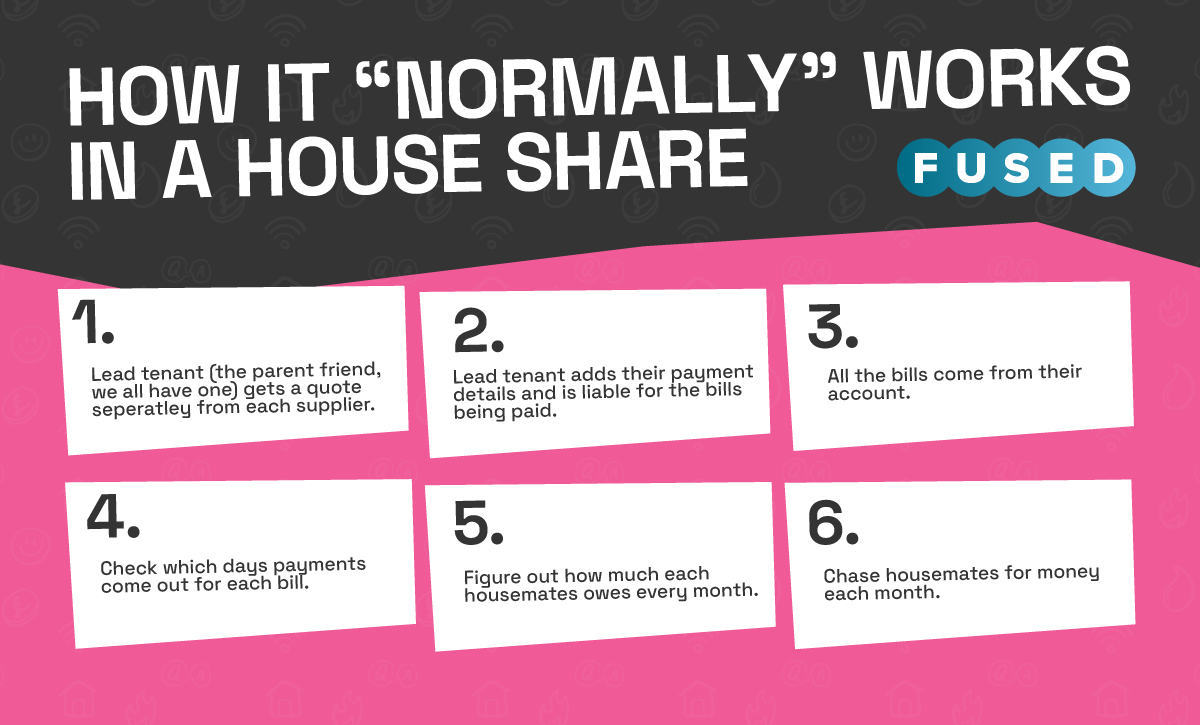

How it "normally" works in a house share:

- Lead tenant (the Parent Friend, we all have one) gets a quote separately from each supplier.

- Lead tenant adds their bank details and is liable for the bills being paid.

- All the bills come from their account

- Check which day payments come out for each bill

- Figure out how much each housemate owes every month

- Chase housemates for money each month.

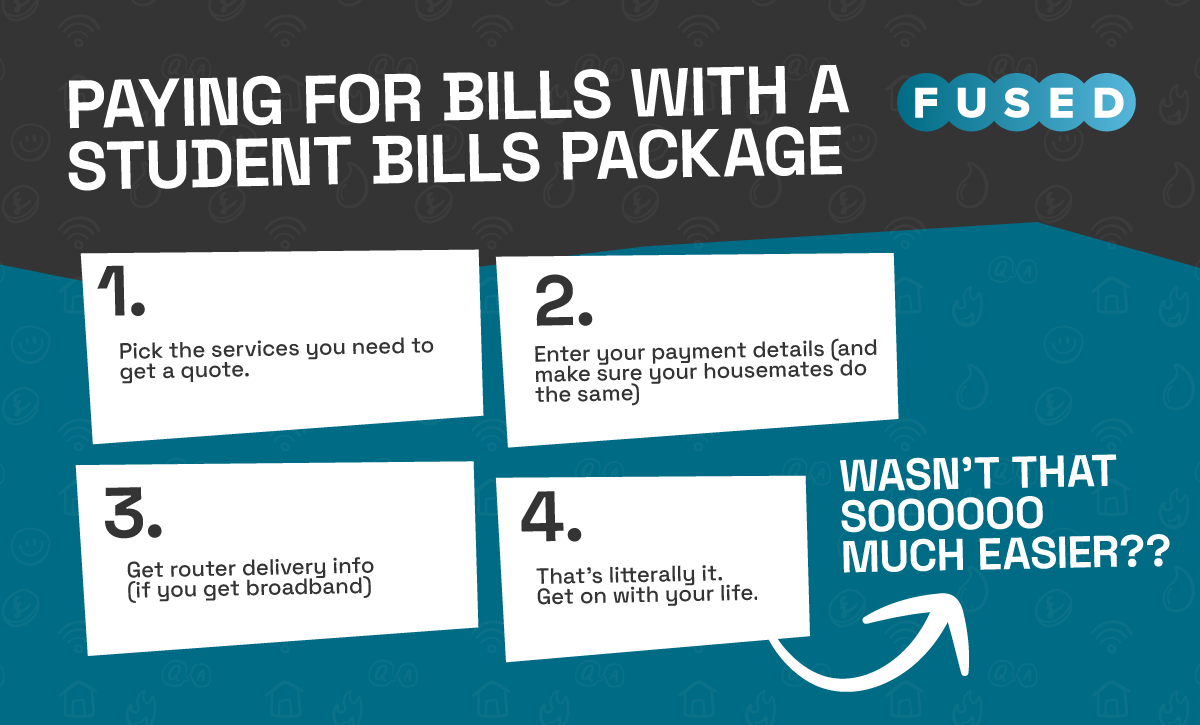

Paying for bills with a student bills package

- Pick the services you need to get a quote.

- Include everything from energy bills to your broadband deal.

- Enter your bank details or card details (and make sure your housemates do the same)

- Get router delivery info (if you choose broadband)

- That's literally it. Get on with your life.

- Learn more about student bills packages right here.

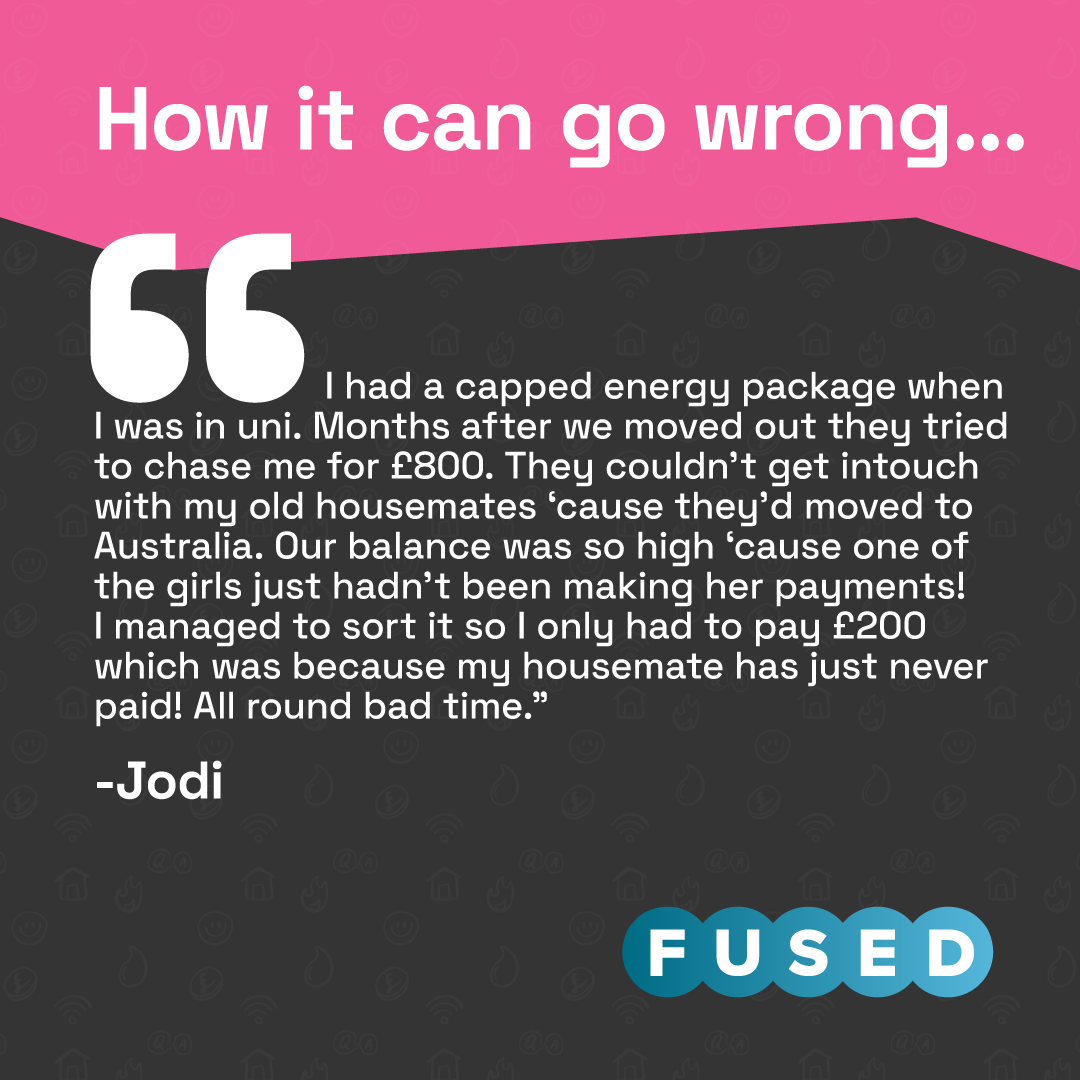

How sorting your student bills can go wrong

Jodie had a really awful time with her student house bills when one of her housemates just...didn't pay 😬

What is a lead tenant?

A lead tenant is the person who is responsible for the bills getting paid. They're also the point of contact for any issues with the payments or service.

So, if your Internet is being weird or you keep getting bills in the wrong name, your lead tenant will be responsible for sorting it out. They'll definitely be the person your service provider gets in touch with first.

That's a lot to deal with on top of uni work, tbh.

What does "liable" or "liable party" mean?

- When you sign up with a utility provider, there'll usually be a liability clause in the terms and conditions of the contract you sign.

- When you sign a contract and become the liable party, you become responsible for the payments and any debt associated with the account.

- If you're using a bills package to split the bills, make sure you check what happens if one of your housemates doesn't pay.

- You usually won't end up with the full amount in your name, which is better news for your credit score, but you could still end up paying more if they don't pay.

What happens if I don't pay bills?

If you stop paying bills you're liable for, here's the situation:

- You don't have any legal protection if you just stop paying bills all together. You've signed a contract agreeing to pay, which is legally binding.

- If you're struggling to pay it's always best to speak to your supplier. They can usually offer rejigged payment methods, a payment plan, or even offer discounts and support.

- If you're behind on energy payments it's considered a "priority debt". It can have a bigger impact on your credit score than other payments like credit cards, so you need to sort it out before anything else.

- Your energy supplier is unlikely to cut you off if you stop paying, but it can happen! Eventually your account will be passed to a debt collection agency and bailiffs to get the money owed.

- You can also get a court-ordered pre-payment meter if you repeatedly miss energy payments.

- Your credit score will probably go down if you miss any bill payment, making it more difficult to get loans, credit cards or an overdraft if you need it in the future.

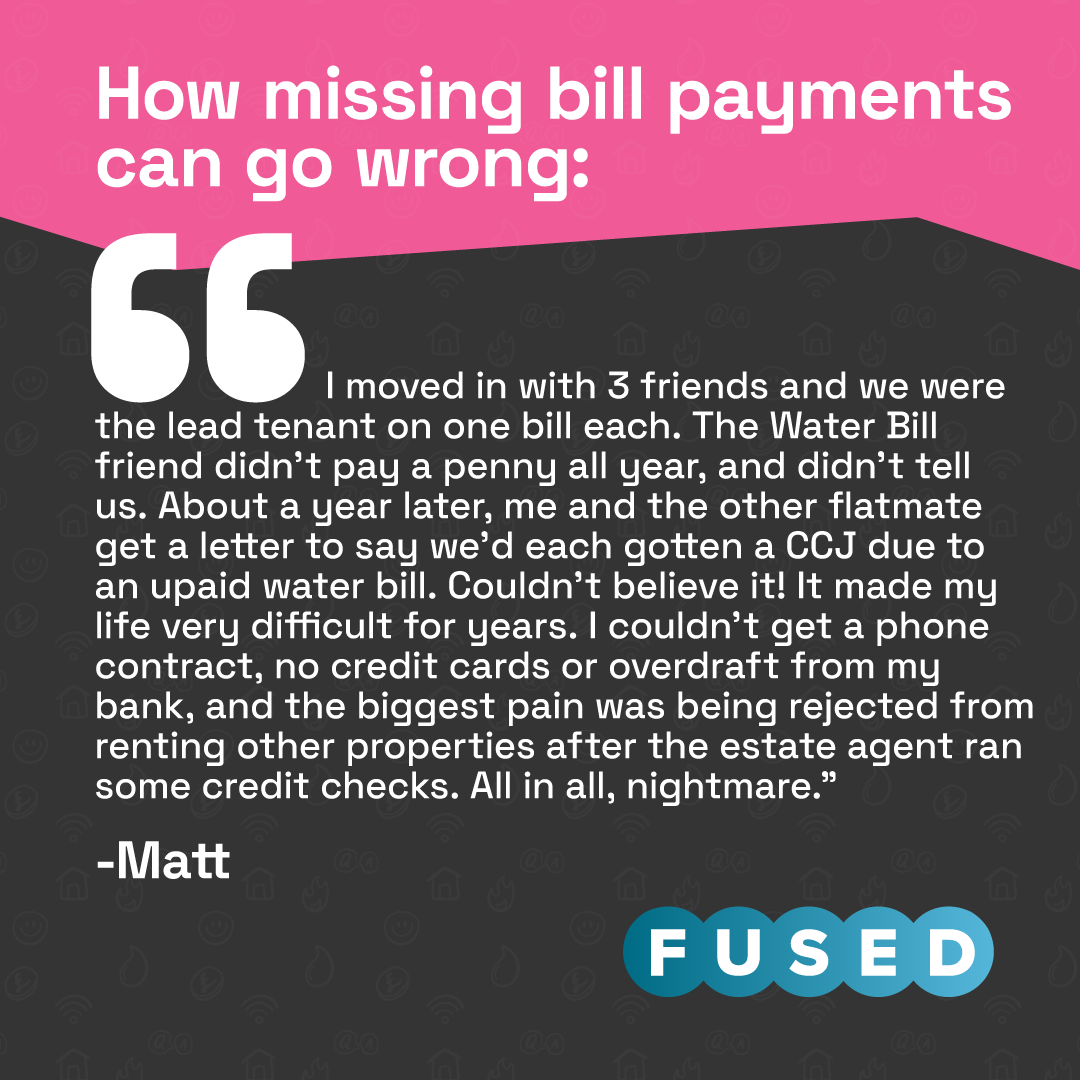

- You can also end up with a CCJ, or county court judgement, which is kept on your record for six years and has a huuuuuge impact on your credit rating.

What's a credit rating?

This could be a whole guide on its own, but we'll try to keep it quick for now. The short version is that a credit rating is a score to show how likely you are to be able to repay any loans or other credit given to you.

Things that can improve your credit rating include:

- Making regular payments for services: your mobile contract, credit cards and utility bills

- Having a range of credit from a range of sources. This shows that you can manage your money "effectively", apparently.

- Having a mortgage (not relevant for most students, but it's true so we included it)

- Making payments to afterpay services like Klarna and ClearPay (as long as you can actually afford the payments)

Basically it's a complex calculation, and different credit scores assess things slightly differently.

Check out our complete guide to student finance for more info.

How missing bill payments can go wrong:

Things that can lower your credit score include:

- Missing payments on existing debt or utility bills

- Getting your debt passed to a debt collection agency

- Too many "hard" credit checks in a short period of time

- A CCJ (county court judgement) will dramatically reduce your credit score for six years

A lower credit rating makes it more difficult to access payment plans, for your mobile or a car, even renting a property and it can really damage your chances of getting credit cards or bigger loans like mortgages too.

There's a lot to consider, especially if you don't want to get it wrong 😬

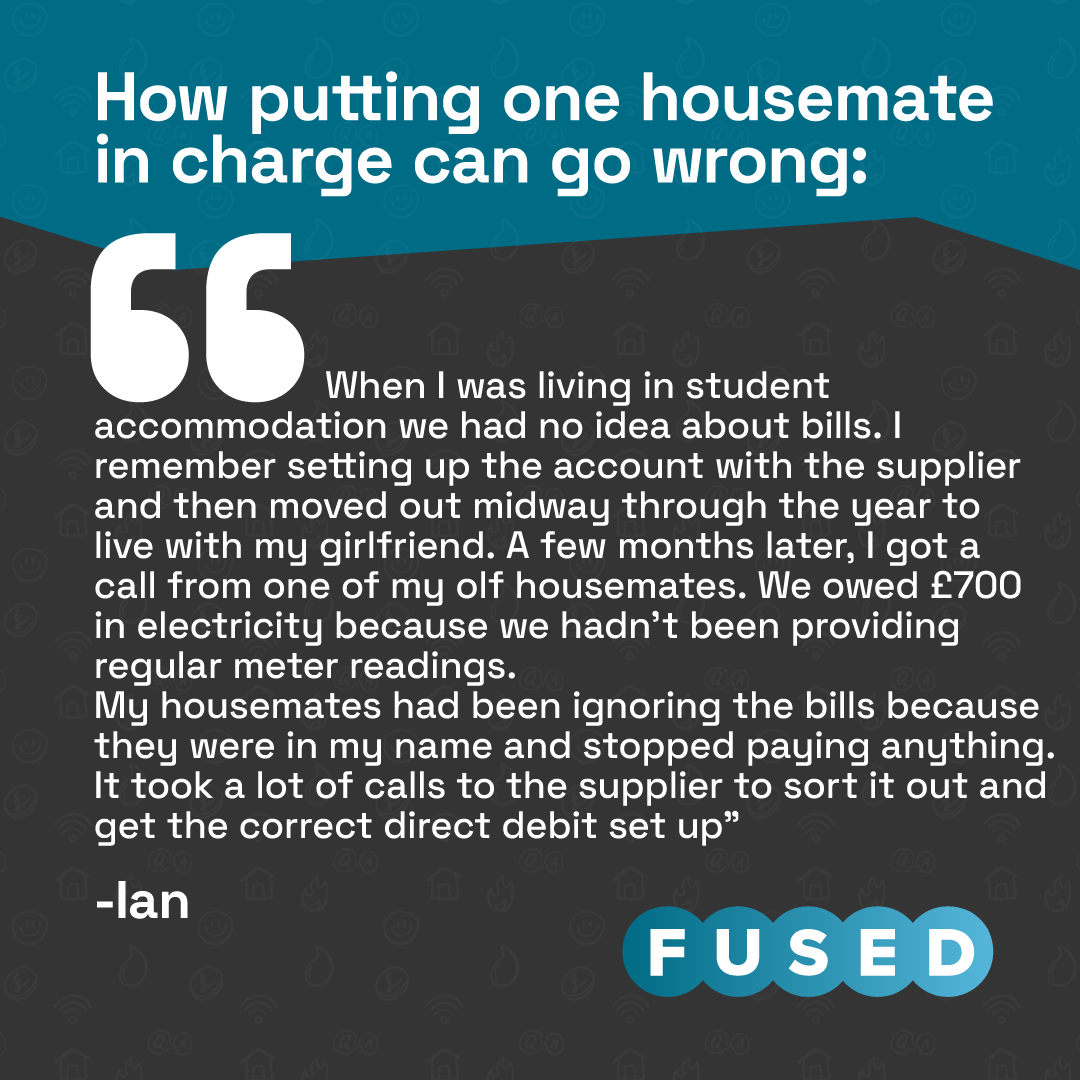

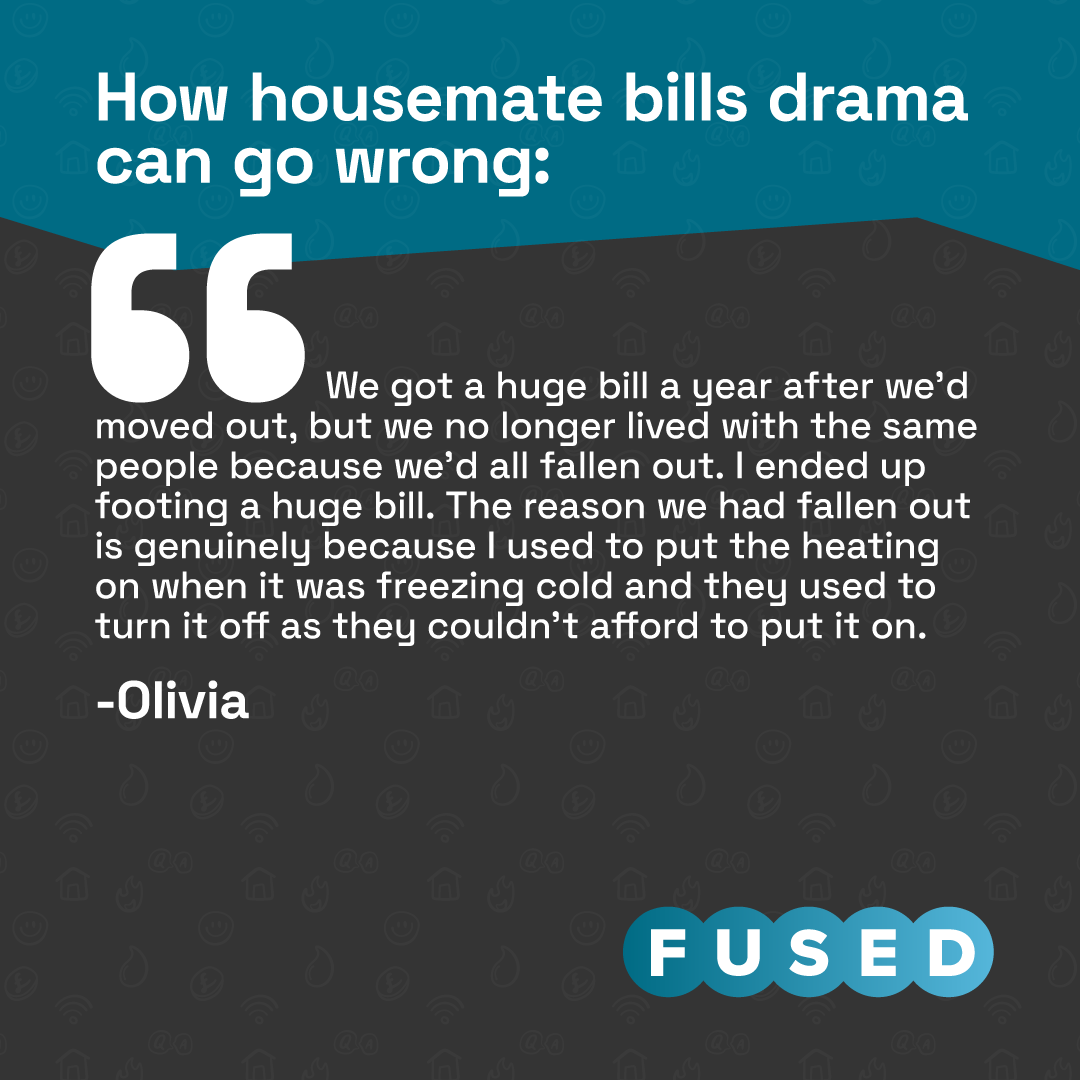

You've read a bit about how bills can mess up your finances and make things mega stressful, but one thing that we can't stress enough is just how much wonky bills can mess up your friendships.

How housemate bills drama can go wrong:

Usually people share houses because they're mates, and messing it up over something that can be so simple is the worst. Arguments with your housematescan be avoided, especially when it comes to bills!

We genuinely hope this guide helps you find the best way to sort bills for you and your housemates. If you have any questions, please drop us a line. We'd love to know what you need to know!

How to sort your student bills with the best-rated student bills specialists on Trustpilot:

- Learn more about student bills packages

- Get a bills quote for your student house 👀

- Add your payment details, and your housemates' 🔢

- Chill ✌️

More guides understanding bills and money as a student:

- Student bills guide

Learn which utility providers you need to pay. Spoiler alert: energy providers, broadband providers, water suppliers, TV suppliers, TV licence. - Guide to student finances

Learn about student funding and how to manage it. Maintenance loan, bursaries, grants...all that stuff. - Unlimited Energy Deals vs. Capped - what's best for you?

How is an Unlimited Energy deal better than a standard tariff? Let's find out. - How to save money at uni

Some tips and advice to help you avoid money worries at uni. Student discounts, cashback deals and more! - What's happening with the energy price cap?

There's a good chance your current energy supplier will change your price with the energy price cap. Learn why! - How to get the deposit back for your student house

If you're living in a student property, here's a guide to getting your deposit back.