When you think about student finance in the UK, you probably think of applying for your student loans via Student Finance England, Scotland, Wales, or Northern Ireland.

This is a big step for most students, but there are loads more to consider when it comes to managing your money at uni. Here's a rundown of the main things you need to consider to keep your finances in check as an undergraduate student.

Student finance applications

Other sources of student funding

UK student loan myths

Your monthly expenses as a student

Student finance applications in the UK

If you're eligible for funding from the UK government, you can apply for:

- Student loans and/or grants to help with living costs while you're a full-time student

Your household income can impact the exact level of maintenance loan you're awarded, but all students are entitled to borrow something to help with living costs. - Tuition fee loan

Student loans

You apply for funding through the service for the country where you usually live, not the country you'll be studying in.

e.g. If you live in England, but will be going to uni in Wales, you need to apply for funding via Student Finance England.

Full-time undergraduate students get different funding to part-time students and postgraduate students, depending on where in the UK you're studying, so check out the specifics for wherever you live!

The application process is slightly different depending on where in the UK you usually live. England, Northern Ireland, Scotland and Wales all have their student finance service, with slightly different rules, but the basics are the same.

You can usually only apply for funding from the UK government if you're a UK citizen or a UK resident with a specific type of visa. You check out the eligibility for funding (if any) as aforeign student on the UK govt website.

The deadline for Student Finance is usually at the end of June if you want to get your funding in time for the start of term in September or October. If you apply late you'll still get funding if you're eligible, you just might have some money troubles for a few weeks while your application is assessed.

Other places to get loans, grants and other funding as a student

Depending on your circumstances and what you're studying, you might be entitled to extra funding. There are a few types you could get, and some of these terms are used interchangeably, just to make things more confusing.

-

Bursaries: Bursaries are given to help cover the cost of studying, and are often given to specific subjects or based on your household income. A bursary usually doesn't need to be paid back, but sometimes you might be asked to repay it if you don't finish your course.

-

Grants: Maintenance grants offer support with living costs at uni for some people, and the special support grant is available for disabled students, some parents, and people who claim specific benefits. Travel grants are also available if you're studying abroad as part of your course, or will be on a placement that means you need to travel a lot. It's worth doing some research and asking your uni to see what you might be entitled to.

- Scholarship: Scholarships are usually pretty competitive and offered to support people who excel in their subject or those from backgrounds that are currently underrepresented in a particular field. Again it's worth doing some research to see what's available - some aren't well known and you never know your luck!

UK Student loan myths

Student loans are something most UK students use to fund their education, regardless of their background. Misinformation is almost as common as the loans themselves. Here are some of the big myths busted.

Myth 1: All debt is the same and student loans are a bad idea

Being in debt is nobody's ideal situation, but UK student loans are very different from a private loan you'd get from a bank.

Student loans are funded by the government to cover tuition fees and living costs while you're at uni, and while the amounts can soon add up, you don't need to pay them back until you're earning over a certain wage, and it's always proportionate to your wages, so it's never an unmanageable amount. It also doesn't affect your credit score.

While you should always think carefully about any debt, don't let the big numbers scare you!

Myth 2: You should pay your loan off ASAP

At the end of the day, it's your money, and you can do what you like, but it's important to remember that UK student loans get wiped after about 30 years.

So, while it's true that you will be adding earned interest to your debt, you're unlikely to actually pay that interest back before your debt is cleared unless you're a very high earner. And even then, you could get a better return on that repayment money by investing it elsewhere.

Your tuition fee and maintenance loan can look like a scary amount of money, but make sure you're making a good financial decision, and not throwing money away in a panic.

A quick rundown of monthly student expenses:

Every month at uni you'll need to pay for these things:

-

Rent for yourstudent house

Student halls might charge per semester, but you still need to factor it in! -

Entertainment: (TV package, TV license, Spotify, etc.)

-

Food

This can add up pretty quickly, especially during a cost of living crisis. Your biggest expenses will be essentials like rent, bills, and food. Everything else after that is a "nice to have", but some fun is essential. That's where a budget comes in.

Student bills

Depending on where you live, bills might be included in your monthly rent payment, or you might need to sort the bills for your student house all on your own.

That can be pretty intimidating! Thankfully there's loads of advice out there, including this nifty guide to student bills.

A lot of students opt for astudent bills packagelike the ones we offer at Fused. It'll only take a few mins.

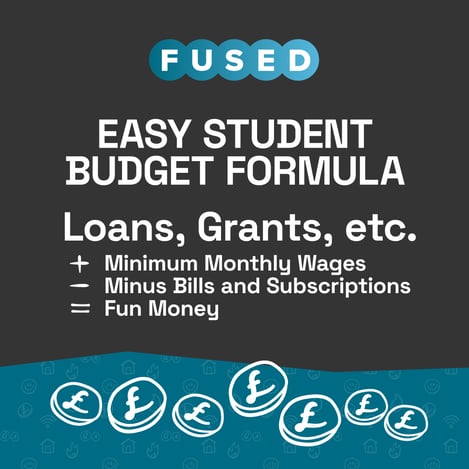

How to make a budget as a student

What is a budget?

A budget is a plan of how much money you have and how you'll spend it. This is especially useful as a student when money is tight and you need to make sure you have enough cash for essentials, and enough to relax and enjoy yourself.

You'd be surprised how much of your student loan the "basics" like utility bills and food eat up, so you might have less for clothes and nights out than you'd think. Knowing that ahead of time means you won't overspend and end up in debt, with a dodgy credit score.

How to stick to your student budget

Knowing what you have to spend and actually sticking to that amount are totally different things, and it can be really tough if it seems like everybody else is spending more.

-

Be brave! Money is tight for most students, so don't worry about speaking up if something is out of your budget. You might even make it easier for other people in your friend group to do the same.

FYI: This approach is a good way to filter out toxic friendships. Pressured to overspend? They're not your friend. Byeeee. -

Prioritise spending on things you actually enjoy and that actually matter to you - don't say yes to every night out if you don't want to go, so you have the cash for hobbies and events that get you excited.

-

Nights in can be just as much fun and way cheaper than a night out. Plus you can stay in your PJs.

-

Look for student discounts or cheaper options for things you'd love to do. Check out our guide to saving money as a student for the best places to look.

-

Remember that you don't know how people are funding their lifestyle. There might be a lot of debt building up behind those endless takeaways and nights out.

-

Try a savings challenge like a No Spend Week to make sticking to your budget interesting!

Cheap vs. Good Value

Getting the cheapest backpack you can find at the start of the year seems like a great idea, until it falls to bits before Halloween and you have to shell out on the premium version anyway.

Here are some tips on where to spend money and where it makes sense to save:

-

Stuff you'll definitely use is always worth spending on shoes, laptop, backpack. You can usually get a good deal on these

-

Some services that look cheap can actually make things way harder. Phone contracts, student energy deals, and cheap broadband are some examples where the cheapest option definitely isn't always the best.

-

Staple food like pasta and rice can usually be bought in bulk for way less, and you won't notice the difference

-

Some store-brand food is just as good as the branded version, and some definitely isn't. Proceed with caution. Here's a rundown from Which? so you can see where to save.

What is a credit score?

Your credit score is a number assigned to you by one of three main credit scoring agencies to score how reliably you make payments that you owe to businesses or banks.

It's not a perfect system, and lots of payments you make might not positively impact your score, but when you miss a payment it could negatively impact your score. It's pretty complex.

The important thing to know is:

-

If you haven't budgeted and end up not paying your bills, this can have a huge negative impact on your credit score and mean you can't get a phone contract, a flat to rent or even a mortgage in the future!

Here are just a few examples of borrowing that can impact your credit score for better or worse:

- Klarna, ClearPay, Monzo Flex, etc

- Bill payments to some suppliers

- Credit cards

- Mobile contracts in your name

Financial mistakes (almost) all students make

Borrowing money

It's super easy to fall into a debt spiral as a student, and you wouldn't be the first person to do it.

Remember that the cash you borrow isn't free money. You will need to pay it back, and unlike your student loan, it won't wait until you're earning above a certain threshold.

Careful borrowing can boost your credit score, but don't agree to any repayments you can't afford, and don't borrow assuming you'll find a job or find the money from somewhere else. Be realistic!

Not sticking to a budget

"For nights out, etc, get out an amount of cash and STICK TO IT. It helps you figure out how much you're spending and stops drunk-you buying rounds for everyone on a whim." - Finn, Sales

"Keep all of your bills money in a separate bank account, so that you're not tempted to spend it and "deal with that problem later" - Lee, Commercial Ops

Other handy guides:

Guide to student bills

How to pay the bills at your student house

Guide to student broadband

How to save money at uni

11 easy ways to save energy