Sorting bills on your own for the first time is a lot, and it’s not obvious what you’re even supposed to do.

At the end of the day all you need to do is make sure your main bills are paid in full and on time. Super simple! It’s even easier with these handy guides.

-

The guide you’re reading right now covers the different ways you can pay your bills.

-

Then this guide 👉 covers all the bills you need to pay in your student house.

Let’s get started!

Share with your housemates so you all know what you're getting into, and if it all seems too much, you could always get someone to sort your student bills for you...

Here are links to the important bits:

Ways to pay for your bills

Direct debit

- A direct debit is basically a method of giving your bank permission to send specific amounts directly from your bank account to a company on a regular basis

- Direct Debit is most often used for subscriptions and bills.

- You need to be told in advance how much will be taken and when, so only the agreed amount will come out of your account.

- All Direct Debits come with the Direct Debit Guarantee. This covers lots of stuff, but the big one is that if the wrong payment is taken, or is taken on the wrong date, you get a full refund.

-

You can also cancel a Direct Debit at any time.

Direct debit is the easiest way to handle payments that need to come out of your account every month, and every service should offer it as an option.

Card payment

Card payments work in a similar way to a direct debit. You pop your card details in when you sign up, and the agreed amount gets taken out of your account each month.

This is super easy, but throws up more problems than direct debits:

-

If you have to cancel your card because it's lost or stolen, your payments will fail and you could end up in arrears 😬

-

You'll run into the same problem when your card expires, meaning you need to update your payment details with all of your providers. Ugh.

Split the bills with your bank

Depending which bank you're with, you might be able to split your bills with an in-app feature. This means no more chasing housemates every month, or stressing about whether you've paid your mates back.

-

You'll still need to set up with every supplier, and somebody will need to be the lead tenant, but you won't need to remember to chase or pay your housemates every month.

-

You still need to set up every service individually

-

Your payments might still come out on different dates

Split the bills with a student bills package

This option is a bit different, but makes everything sooooooo much easier.

A student bills package is a custom option for your student house. Put all of the services you want into one package, with one monthly payment split equally between housemates.

Imagine not having to worry about everything in this blog and our other massive bills guide??

How a bills package works:

-

Add your details to pay via direct debit or card

-

Make sure your housemates do the same

-

Everybody gets billed for an equal share of the bills every month

If you want to see what the best-rated student bills package could cost for you and your housemates, get a quick quote.

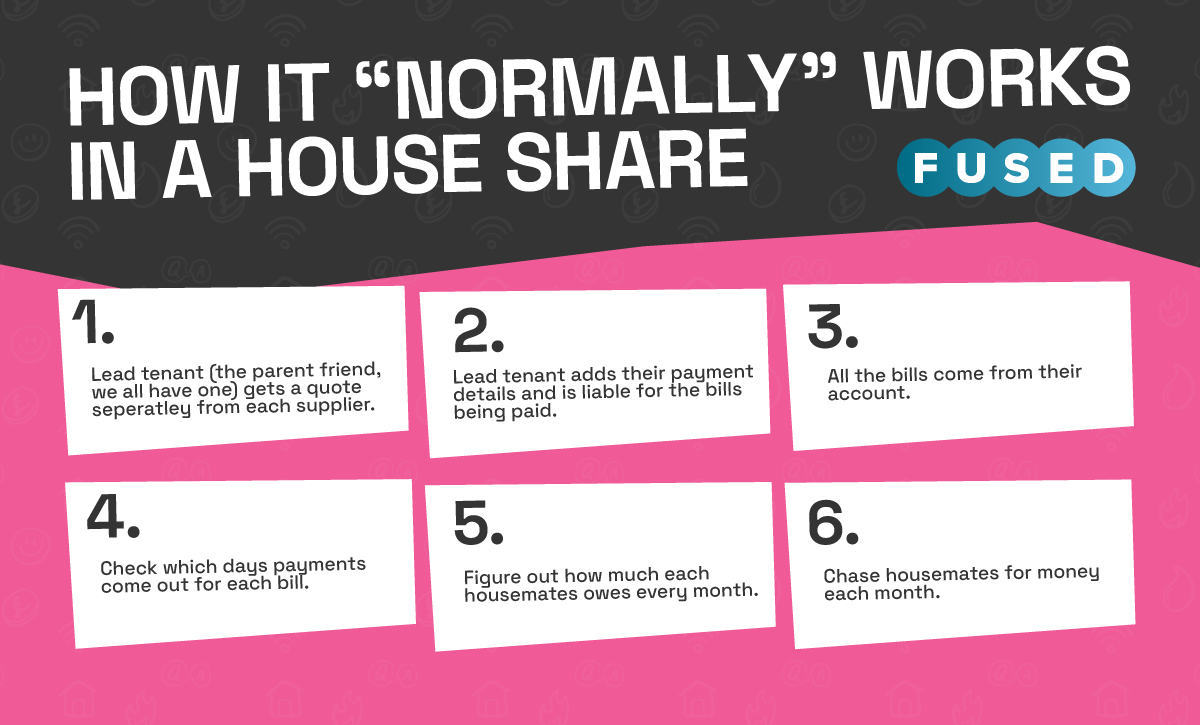

How it "normally" works in a house share:

1. Lead tenant (the Parent Friend, we all have one) gets a quote separately from each supplier.

2. Lead tenant adds their payment details and is liable for the bills being paid.

3. All the bills come from their account

4. Check which day payments come out for each bill

5. Figure out how much each housemate owes every month

6. Chase housemates for money each month

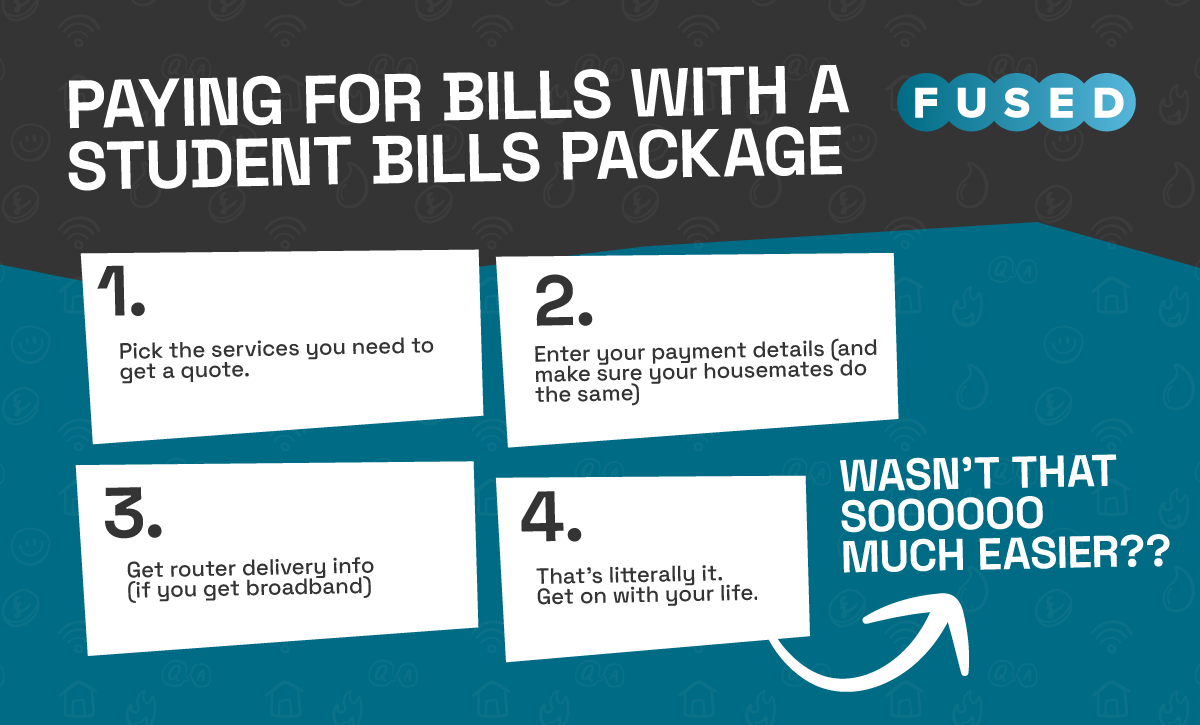

Paying for bills with a student bills package

1. Pick the services you need to get a quote

2. Enter your payment details (and make sure your housemates do the same)

3. Get router delivery info (if you get broadband)

4. That's literally it. Get on with your life.

Get a quote for the best-rated student bills package right here.

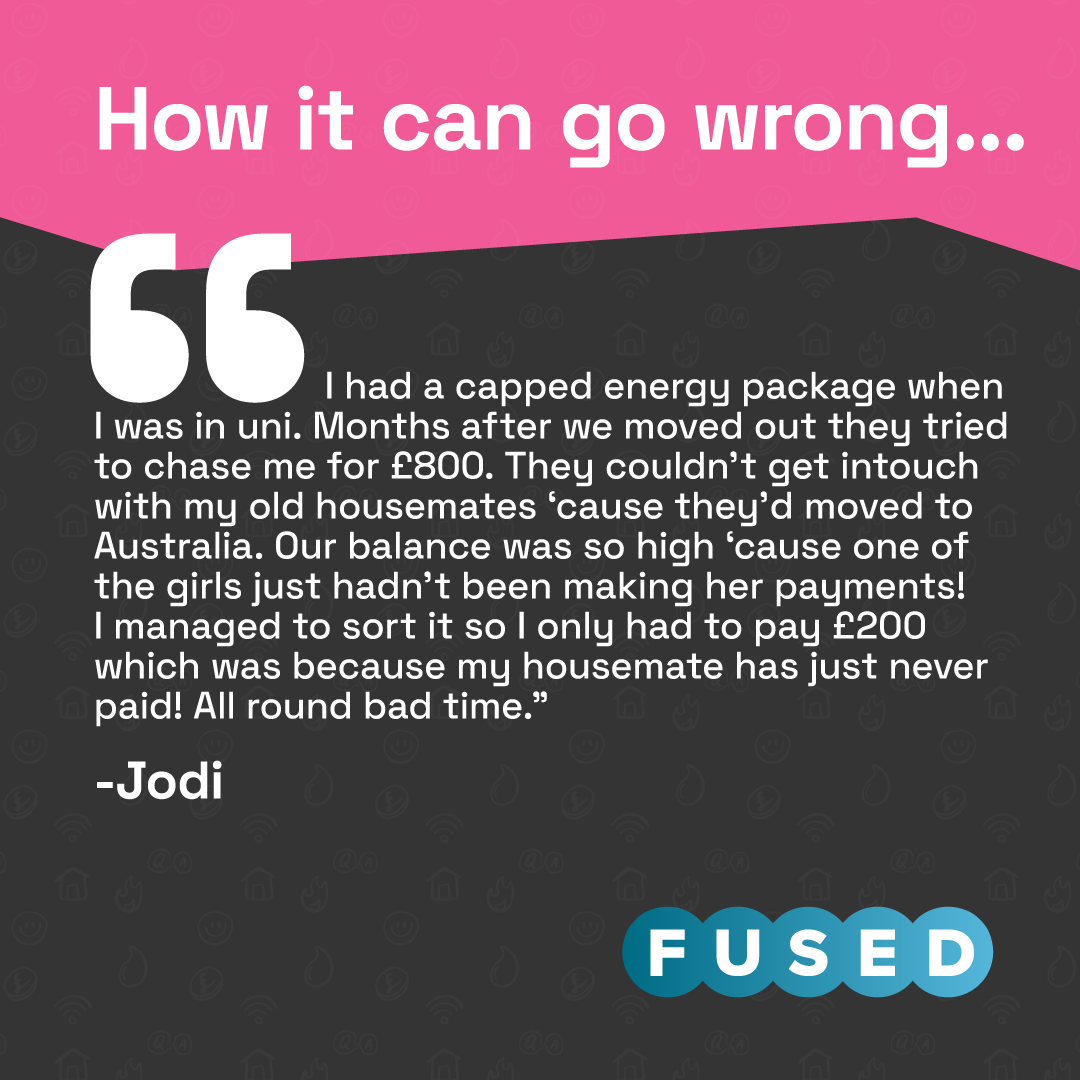

How sorting your student bills can go wrong

Jodi had a really awful time with her student house share bills when one of her housemates just...didn't pay 😬

What is a lead tenant?

A lead tenant is the person who is responsible for the bills getting paid. They're also the point of contact for any issues with the payments or service. So, if your Internet is being weird or you keep getting bills in the wrong name, your lead tenant will be responsible for sorting it out. They'll definitely be the person your service provider gets in touch with first.

That's a lot to deal with on top of uni work, tbh.

What does "liable" or "liable party" mean?

-

When you sign up for a service, there'll usually be a liability clause in the terms and conditions of the contract you sign.

-

When you sign a contract and become the liable party, you become responsible for the payments and any debt associated with the account.

-

If you're using a bills package to split the bills, make sure you check what happens if one of your housemates doesn't pay.

-

You usually won't end up with the full amount in your name, which is better news for your credit score, but you could still end

-

What happens if I don't pay bills?

If you stop paying bills you're liable for, here's the situation:

-

You don't have any legal protection if you just stop paying bills all together. You've signed a contract agreeing to pay, which is legally binding.

-

If you're struggling to pay it's always best to speak to your supplier. They can usually offer rejigged payment methods, a payment plan, or even offer discounts and support.

-

If you're behind on energy payments it's considered a "priority debt". It can have a bigger impact on your credit score than other payments like credit cards, so you need to sort it out before anything else.

-

Your energy supplier is unlikely to cut you off if you stop paying, but it can happen! Eventually your account will be passed to a debt collection agency and bailiffs to get the money owed.

-

You can also get a court-ordered pre-payment meter if you repeatedly miss energy payments, but this is on hold at the moment.

-

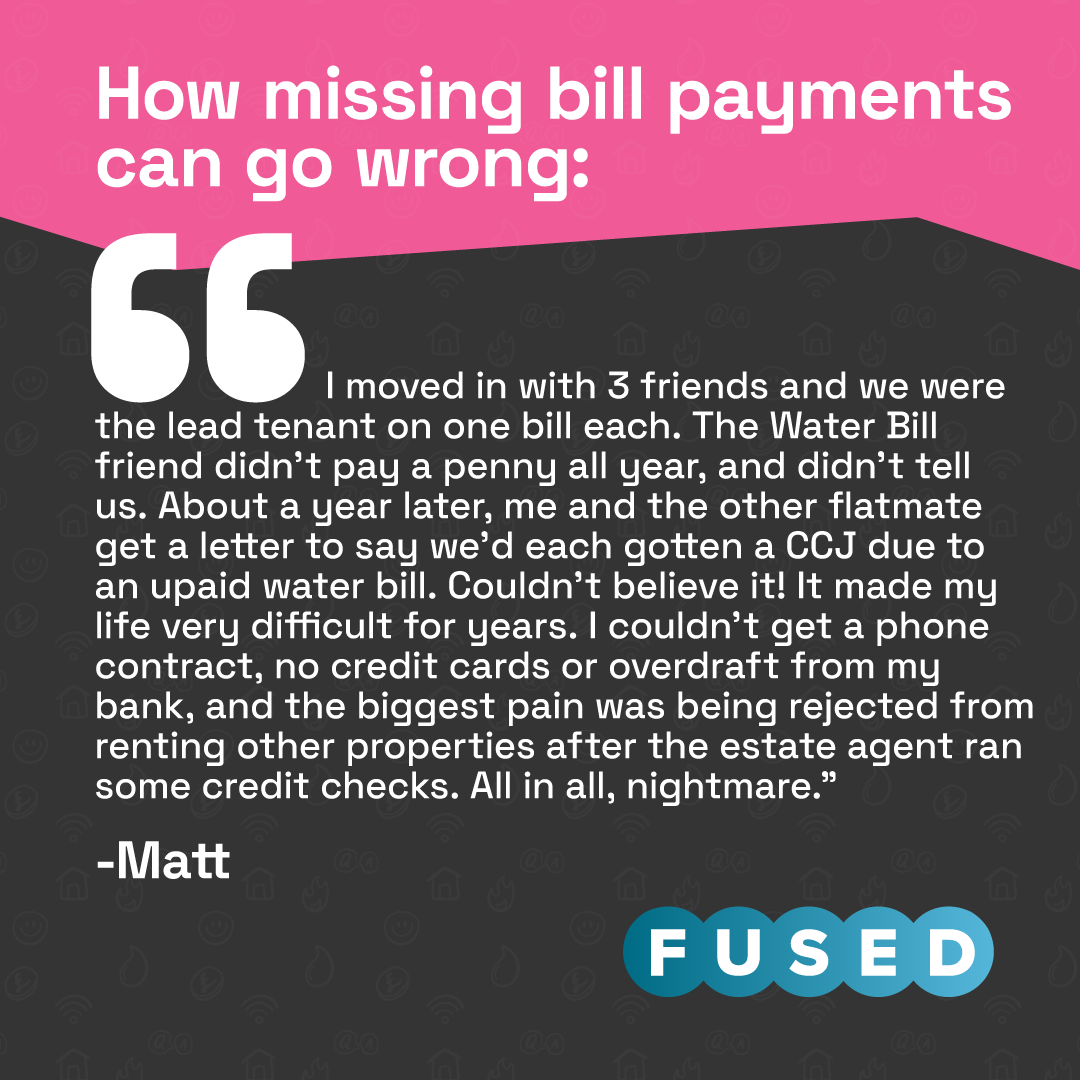

Your credit score will probably go down if you miss any bill payment, making it more difficult to get loans, credit cards or an overdraft if you need it in the future.

-

You can also end up with a CCJ, or county court judgement, which is kept on your record for six years and has a huuuuuge impact on your credit rating.

What's a credit rating?

This could be a whole guide on its own, but we'll try to keep it quick for now. The short version is that a credit rating is a score to show how likely you are to be able to repay any loans or other credit given to you.

Things that can improve your credit rating include:

-

Making regular payments for services: your mobile contract, credit cards and utility bills

-

Having a range of credit from a range of sources. This shows that you can manage your money "effectively", apparently.

-

Having a mortgage (not relevant for most students, but still...)

-

Making payments to afterpay services like Klarna and ClearPay (as long as you can actually afford the payments)

Basically it's a complex calculation, and different credit scores assess things slightly differently.

How missing bill payments can go wrong:

Things that can lower your credit score include:

-

Missing payments on existing debt or utility bills

-

Getting your debt passed to a debt collection agency

-

Too many "hard" credit checks in a short period of time

-

A CCJ (county court judgement) will dramatically reduce your credit score for six years

A lower credit rating makes it more difficult to access payment plans, for your mobile or a car, even renting a property and it can really damage your chances of getting credit cards or bigger loans like mortgages too.

There's a lot to consider, especially if you don't want to get it wrong 😬

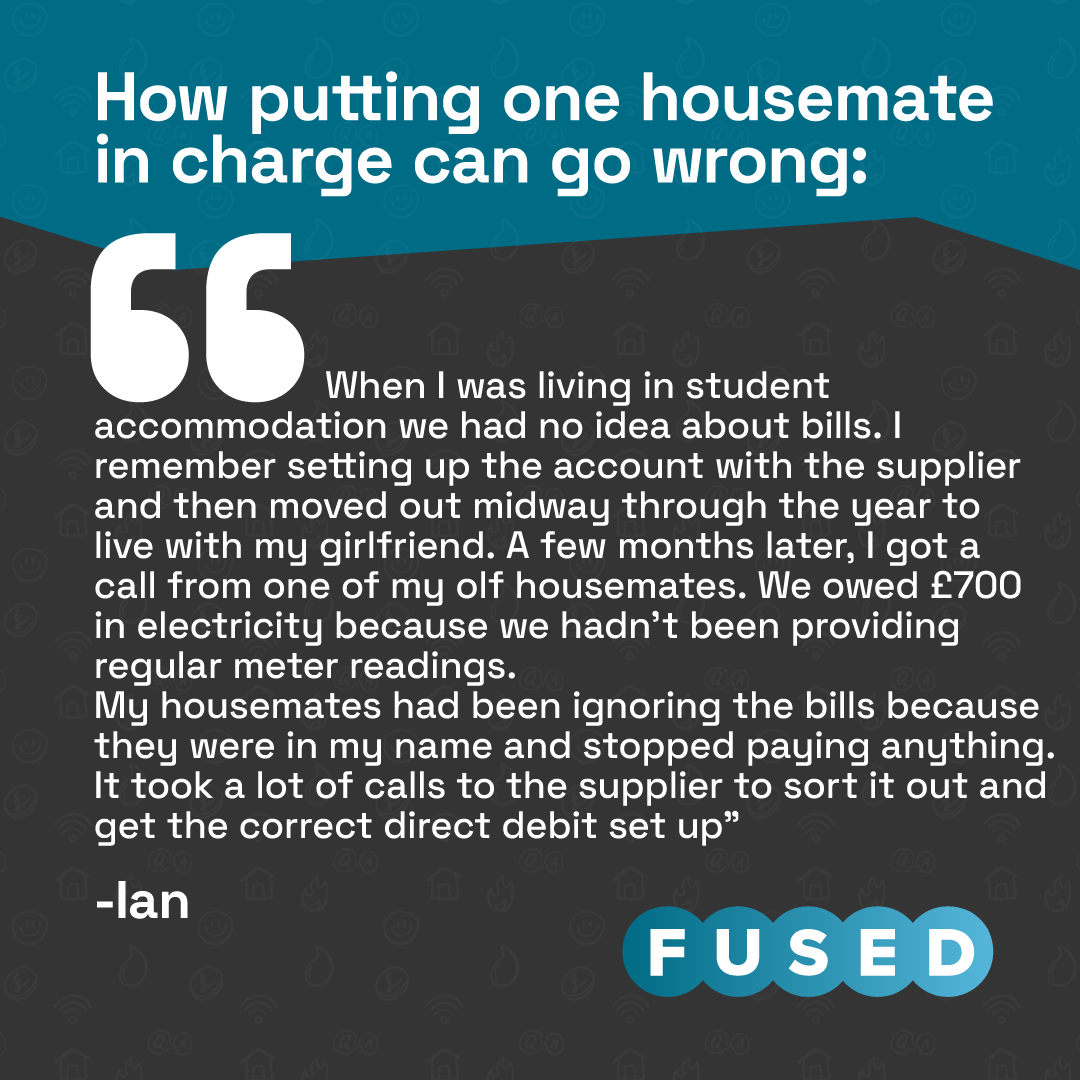

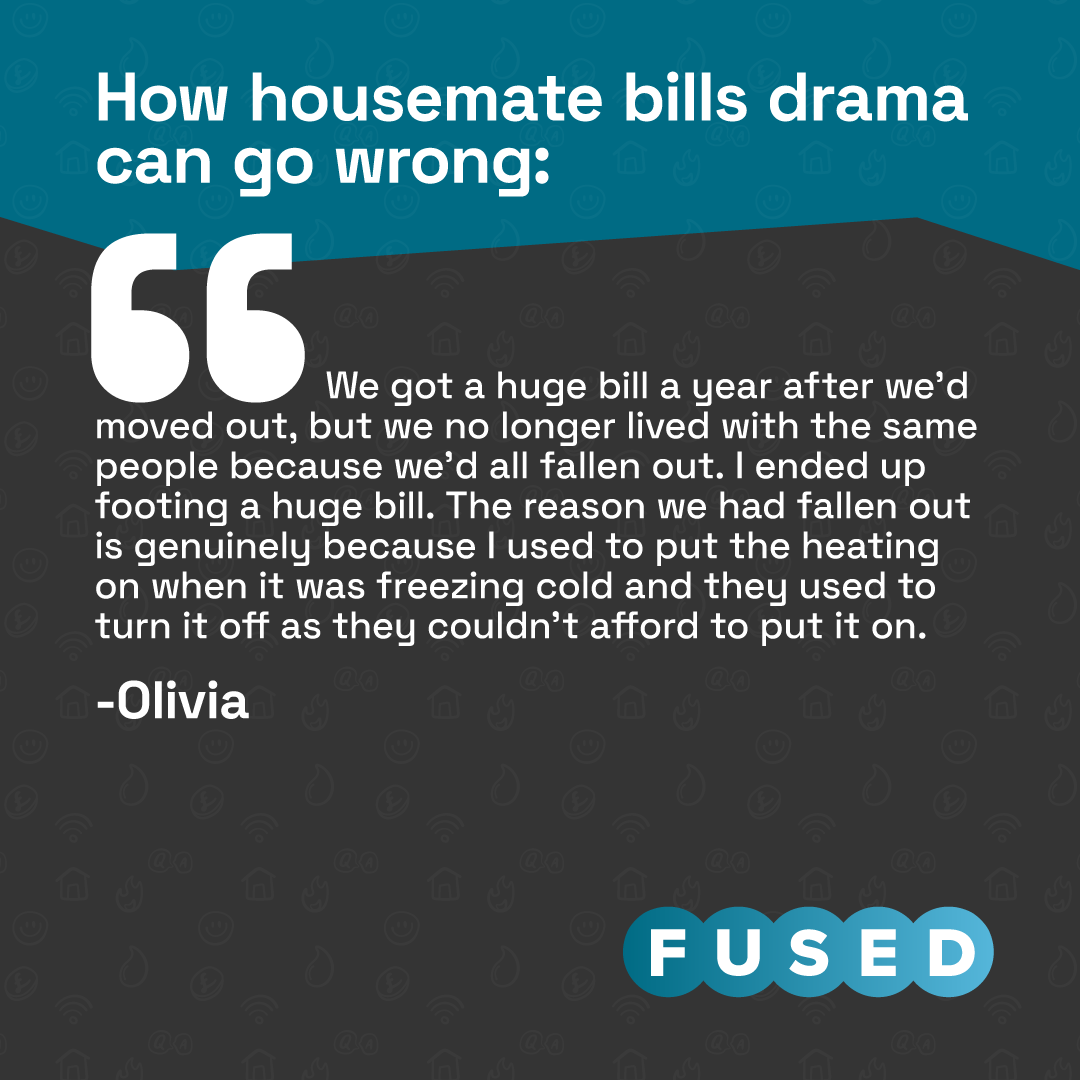

You've read a bit about how bills can mess up your finances and make things mega stressful, but one thing that we can't stress enough is just how much wonky bills can mess up your friendships.

How housemate bills drama can go wrong:

Usually people share houses because they're mates, and messing it up over something that can be so simple is the worst.

We genuinely hope this guide helps you find the best way to sort bills for you and your housemates. If you have any questions, please drop us a line. We'd love to know what you need to know!

How to sort your student bills with the best-rated student bills service:

- Follow this link 🚶

- Get a quote 👀

- Add your payment details, and your housemates' 🔢

- Chill ✌️